Dynamic Planner welcomes significant investment from FPE capital

Press contacts

Joanne Macklin, PR Manager

joannemacklin@dynamicplanner.com

07956 575743

Yasmina Siadatan, Sales & Marketing Director

yasminasiadatan@dynamicplanner.com

07813 192909

Further Information

Dynamic Planner enables UK financial advice firms to match people with suitable portfolios through engaging financial plans. It is an end-to-end, risk-based financial planning system - combining intuitive financial planning technology with a trusted, independent asset risk model.

Founded in 2003, at the heart of Dynamic Planner is an asset risk model with a 15-year track record of success, ensuring investment suitability - using more than 2,400 covariance correlations to assess the risk of tens of thousands of investments and client portfolios daily.

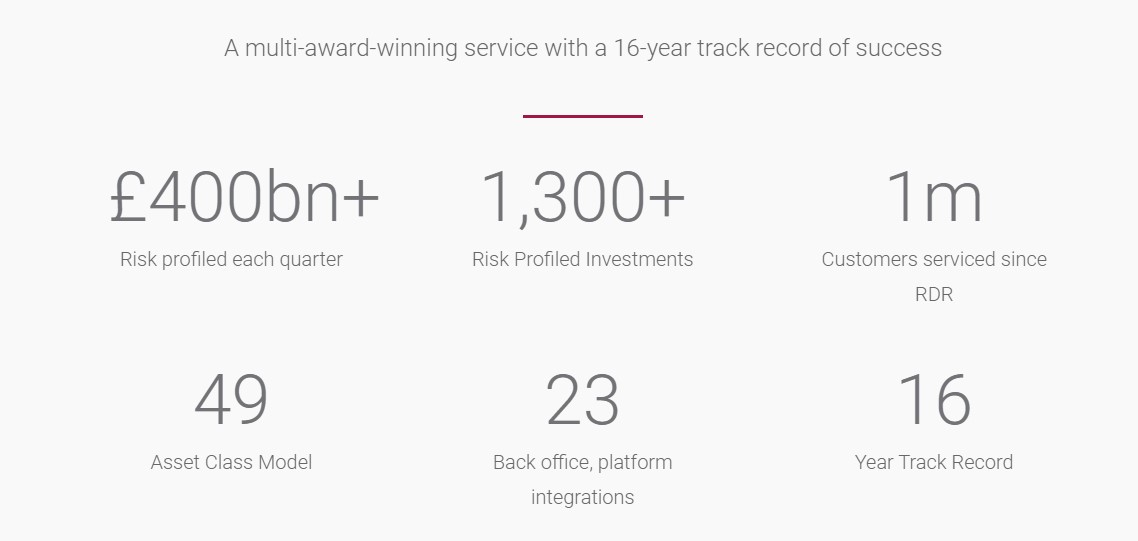

Dynamic Planner powers the MSCI Dynamic Planner Indices and is used by leading asset managers to risk profile or target more than £400bn of investments. Its technology is mobile-friendly, secure, cloud-based and integrated with leading industry CRMs and platforms and providers.

It is a complete and yet flexible system for all of an advice firm’s planning and suitability needs, using an independent standard for risk profiling throughout to ensure nothing is ever lost in translation in the planning and advice process.

How do we help advice firms?

1. Review a client’s risk profile, current portfolio and situation

2. Cash flow plans using goal and risk based financial planning

3. Research and recommend suitable products, platforms and investments, which match your client’s needs, don’t take unnecessary risk and represent good value

Brands

Products

Dynamic Planner is a multi-award-winning service with a 16-year track record of success that helps you ensure investment suitability initially and on an ongoing basis. Dynamic Planner is the most widely used risk profiling and asset allocation process in the UK and is used by thousands of advisers and paraplanners – from large networks and nationals to high quality regional and local firms and private client management firms up and down the country. A growing number of firms use Dynamic Planner internationally too.

Risk Profiling

Accurate risk profiling helps build longer, deeper relationships with clients, helping them recognise the value that you and your firm bring, and trusting you to advise on more of the things that matter to them. Accurate risk profiling results in a greater likelihood that clients will meet their long-term financial goals, but also that in a market downturn they will be comfortable with any short-term falls in value. Crucially, good risk profiling promotes compliance with FCA regulation and avoidance of regulatory sanction or client redress. At the same time, the independent, robust asset allocations created for each risk profile can help you deliver good, risk-adjusted returns to your clients.

Portfolio Review

Ensuring the suitability of a portfolio is central to the value you bring to your clients and a suitable portfolio provides a higher chance of your clients achieving what’s important to them while helping avoid risks they are not willing or able to take. Efficiently and accurately completing a portfolio review is becoming harder as client data is sourced from multiple places, then analysed consistently. With Dynamic Planner, portfolio details can be uploaded automatically from 23 back offices, platforms and providers. As suitability remains a key focus of the FCA and Europe’s MiFID II regulation, 2019 has seen a significant enhancement to the Dynamic Planner Client Review process ensuring ongoing investment suitability. Read more about the new Client Review Process from Dynamic Planner here.

Asset Allocation

Dynamic Planner’s asset allocation model was first developed in 2005 and has been continually refined and advanced ever since. It is the engine behind the risk-reward trade-off for each client’s portfolio, driving expected returns and the risk assessment of funds and strategies. Underlying investments have grown from a range of eight to 49 individual asset classes, allowing your firm to reflect risk requirements accurately and build portfolios that can deliver the returns your clients need. Benchmark asset allocations are reviewed and revised each quarter.

Cash Flow Planning

The Dynamic Planner risk-based cash flow plan helps you test each client’s capacity for loss at the point of advice and into the future. In line with MiFID II requirements, the cash flow plan can be revisited during an annual review to check if the client’s needs have changed and to ensure that the investment strategy remains suitable. Dynamic Planner also supports more detailed cash flow planning, enabling you to further help clients understand their future expenditure and income streams and how their financial planning may need to adapt.

Research and Recommendations

Making sure that your centralised investment proposition and recommendations are consistent with your client risk profiles is key to ensuring that every client stands the best chance of achieving the investment goals that matter to them at an acceptable level of risk. Consistency is also key to ensuring investment suitability from a regulatory perspective so that there is a clear link between the recommended investments and the client risk profile. Dynamic Planner helps you do this efficiently while increasing the likelihood of good risk-adjusted returns for your clients.

Client Reports

Demonstrating value throughout the advice and servicing process is key for successful advice firms today. With continued pressure from the regulator to reduce fees and improve transparency, firms must communicate clearly and professionally, and most importantly clients want and need to easily understand how their portfolio is invested and why. Dynamic Planner enables you to generate beautiful magazine quality reports which clearly demonstrate your firm’s value and brand at the touch of a button.

Implementation

Dynamic Planner provides advice firms with a genuine end-to-end process, which saves you time and reduces the cost to service clients. Our service integrates with over 25 leading back-office systems, platforms, and investment providers. This helps ensure that an investment review process that once took many hours can now be completed in under 50 minutes – and implementation instructions can be provided to a wide range of platforms and back offices instantly.

Digital Advice

The Dynamic Planner Risk Profiler app for iPhones and iPads gives you the ability to deliver the Dynamic Planner risk profiler process offline and on the move. Branded customer apps allow you to deliver your professional services across all major web and mobile platforms branded with your logo and colour scheme. You can even deliver automated ISA advice via your website through our AccessAdvice web app.

Ben Goss - Co-Founder & CEO

Industry experience: 24 years, joined Dynamic Planner: 2002

Ben co-founded Dynamic Planner in 2003 to apply the lessons he has learned about how FinTech can be used to support the provision of high quality, suitable investments and advice to all through advice firms. Dynamic Planner has today grown to become the leading provider of a risk and asset allocation-based investment process to IFAs.

In 1998, Ben co-founded Sort, the UK's first online investment adviser. Sort took off, delivering regulated advice to more than 1,000 people a day before being sold to the largest online adviser in the US in 2000. Ben is a former Ernst & Young Entrepreneur of the Year and winner of the Deloitte UK Fast 50, which recognises the 50 fastestgrowing UK tech companies.

Abhi Chatterjee - Head of Asset & Risk Modelling

Industry experience: 14 years, joined Dynamic Planner: 2016

Abhi leads Dynamic Planner's team of analysts, who are responsible for asset allocation and for the Dynamic Planner risk model. He also chairs the Investment Committee.

Previously, Abhi headed up investment risk and qualitative research teams at Columbia Threadneedle Investments, Invesco and the BT Pension Scheme. He has also managed money for hedge funds. Abhi completed his bachelor's degree in mechanical engineering at Jadavpur University in India before achieving a master's in business management (finance) at the University of Reading. He completed a PhD in finance also at the University of Reading and maintains a close relationship with the university.

Jim Henning - Head of Investment Services

Industry experience: 25+ years, joined Dynamic Planner: 2013

Jim is responsible for the development of the Dynamic Planer risk profiling business, the Risk Target Managed service and also various research solutions for both asset manager and adviser clients. This also includes reach into international markets where investment suitability is a key focus.

Jim has more than 25 years' experience specialising in investment platform proposition strategy, design, fund governance mechanisms and promotional support. Prior to Dynamic Planner, Jim was Funds Marketing and Research Manager for Friends Provident International, and held senior marketing roles within a life insurance company background. He has a degree in economics from the University of Birmingham and holds the Investment Management Certificate (IMC).

Chris Jones - Proposition Director

Industry experience: 19 years, joined Dynamic Planner: 2018

He is responsible for Dynamic Planner's investment process proposition and for clients ensuring investment suitability through Dynamic Planner's investment process. He leads Dynamic Planner's 14-strong team of analysts and qualified investment professionals. Chris is a member of the Board and Executive Management Team and ensures that the investment expertise is effectively transmitted through the Dynamic Planner application, so that it is usable and understandable by advisers and their end clients. Previously, Chris built and ran investment propositions for Intrinsic, Blueprint and Bluefin, and was a member of the product and technical team at Bradford & Bingley. He has more than 25 years' industry experience and as both a Chartered and Certified Financial Planner, brings a key financial planning and client perspective to the business.

Yasmina Siadatan - Marketing Director

Industry experience: 3 years, joined Dynamic Planner: 2016

Yasmina is a Marketing Director at Dynamic Planner and part of the Executive Management Team and the Board. She is an integral contributor to decision-making in the business, leading on its marketing-led growth strategy to further build the Dynamic Planner brand. She and her team are responsible for Dynamic Planner's marketing and communications strategy, which includes branding, sponsorship, PR and driving awareness in the retail investment industry through an extensive programme of conferences and events.

Previously, Yasmina worked for Lord Sugar from 2009 having won the fifth series of BBC One's The Apprentice, heading up his flagship tech and digital media organisation. She graduated in economic history from the London School of Economics.

Recommended Content

Cookies

We and selected partners, use cookies or similar technologies as specified in the cookie policy and privacy policy.

You can consent to the use of such technologies by closing this notice.